Top 4 Ways to Deal With Customers With Long Payment Terms

“The early days of the company were mostly about getting enough cash to get to the next month. Even as the company grew and grew it was always about having cash”

– Phil Knight, Founder of Nike

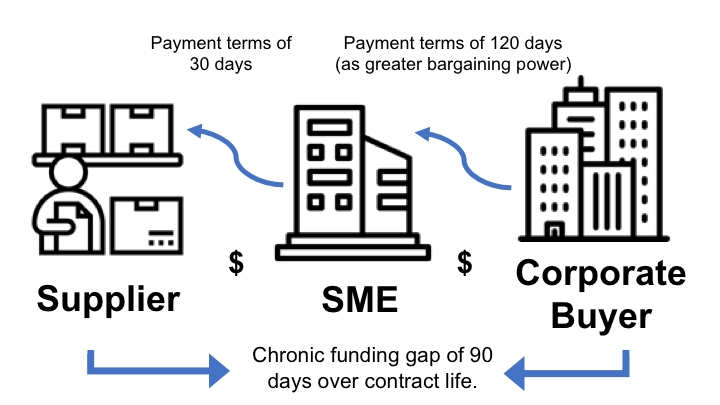

Excessive power of strong corporate customers pose a challenge to the competition policy in creating a fair system for the allocation of goods and services. The GLC Procurement Guidelines lay down the need to develop a stable and competitive supplier base. This may encourage buyers to negotiate terms that help promote long-term relationship with their suppliers. However, albeit the existence of such guidelines, the economy is dynamic and the law can only do so much. Large corporate buyers often utilize their stronger bargaining power to push for lower prices and longer payment terms, causing SMEs to suffer from chronic cash crunch.

How to Deal With Corporate Customers With Long Payment Terms?

1. Offer Early Payment Discounts and Other Incentives

Incentive offers such as free shipping or a small discount up to 10% can be a great motivator when customers are reluctant to agree on shorter credit terms. While it may not be a huge discount, it may be enough to get your customers’ attention. You can also try offering a tier-based discount : 10% discount if customer pays immediately after delivery; 5% discount if customer pays within 7 days after delivery; 3% discount if customer pays within 14 days after delivery.

2. Penalties for Late Payment

Next, the flip side of the above method would be charging more for late payments. However, bear in mind that this may in turn strain the relationship. We understand that it is very frustrating when 90 days credit term turns into 120 days or more. Thus, to avoid such situation, make it clear to your customer on how important their cooperation is to your business. Make them feel appreciated on how quickly and consistently they pay by dropping hints in your communication!

3. Ask for Partial Upfront Payment

Even if you end up having to accept long credit terms, try asking for a partial upfront payment (or a deposit). This may help you improve your business cash flow by securing a portion of payment before providing goods or services. You can use this sum of money to cover the cost of providing goods or services (eg paying your suppliers or employees).

However, regardless of what steps you have taken to develop good credit terms, minimise your credit risks and to improve your cash flow, there is still a chance you will be affected by a late payment or bad debt during your business operations.

Solution: Invoice Financing

A great way of minimising the effect of late payments on your business and preparing for any such eventualities is to use an invoice financing platform such as CapitalBay to turn your credit sales into cash sales, by selling them at a small discount.

Here are some of the key highlights of CapitalBay’s invoice financing program:

- No upfront fee.

- No collateral required.

- Approval as fast as 3 days.

- Cost of financing as low as 0.7% per month.

Always be prepared for rainy days and check out our invoice financing program now.