FAQ for Invoice Financing

General Enquiries

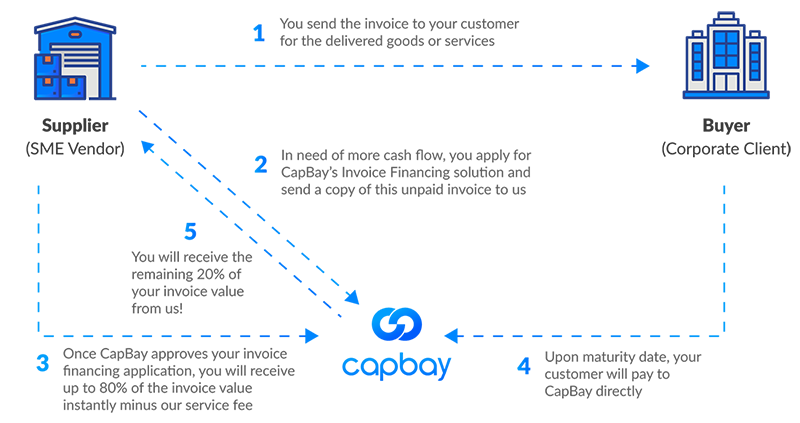

When you provide goods or services to a customer on credit, usually you have to adhere to an agreed payment term ranging from 30 days up to 120 days to receive your payment.

With Invoice financing, you can get instant upfront payment of 80% of the invoice amount without having to wait for the payment terms from your customer. You can have full control of your receivables without any worry!

Refer to the illustration below to understand how Invoice Financing works with CapBay:

- Financing whole ledger or only a few invoices

Putting the whole ledger with CapBay but only financing part of the invoices, or do the whole ledger and access more cash flow. - Credit control

Some factoring houses will insist on managing credit control themselves which could affect and damage the customer relationships.

Read our article to know how CapBay Invoice Financing solution can help unlock a new lifeline of cash for your business

- Your business is providing services or goods to other Malaysian businesses on credit terms (Business-to-Business nature).

- You have mid-to-large size corporation(s) as customer(s) (private or public)

- Your business has an annual revenue of more than $500,000 SGD.

- Your business is a Singaporean registered business (including sole proprietor, enterprise, and Sdn Bhd.).

- Your business is majorly owned by Singaporeans(more than 51%) and has been in operation for at least 1 year.

*You may also get a quote from us even if you do not meet either one of the required criteria stated here. We can’t promise that we will be able to approve your application but we will consider your application, subject to a case-by-case basis.

For new clients, there will be an extra onboarding process which takes about five (5) working days.

- Sign up fee: Free of charge

- Platform Fee: 0.75% – 2.25% on financing amount

- Discount Fee: 0.8% – 1.5% per month on financing amount (10%-18% per annum)

- There are no other hidden charges or fees aside from the ones stated. Stamp Duty & Legal Fees are born by CapBay.

Industry Related

Main contractors are large companies that usually have wider access to financing. Besides that, they are also in a position where they don’t need to hold much working capital themselves as they don’t pay subcontractors until they are paid by their client.

Normally, subcontractors are smaller companies and they need huge working capital to pay for purchasing building materials and labors prior to being paid by the main contractor. The issue which construction companies face is the limitation of finance options because of the challenges that lenders face in underwriting SMEs.

Types of Financing

However, the Bank will charge you for the whole $1,000,000 SGD drawn-down facility. Therefore, you are paying twice the interest for the $500,000 SGD borrowed. With CapBay’s Invoice Financing, you are only charged for the $500,000 SGD you have borrowed.

As for Invoice Finance, say Company A takes invoice financing at 12% per annum. This amounts to 1% interest per month. However, if Company A only needs to use Invoice financing twice in that year, it only needs to pay 1% for each month depending on the invoice tenure. Company A is not required to pay interest for the months when the facility was not used. Invoice financing only charges when it is being used.