CapitalBay Featured in PWC’s 2019 Malaysia Working Capital Study

PWC recently published its 2019 Malaysia Working Capital Study: Optimising Working Capital for Growth. This is available for download on PWC’s website.

The article highlights some key findings from survey data, including:

- The Cash to Cash Cycle (C2C) days has gone from 50 days in 2014 to 54 days in 2018. PWC also found that this would be even higher if not for the inclusion of larger companies in the study. Small and medium sized companies reported further deterioration in their C2C days. Malaysia’s C2C days lag behind Singapore (46 days) , USA (31 days) and Europe (36 days). But is otherwise well-ranked amongst other ASEAN countries.

- The Days of Sales Outstanding (DSO), a measure of the number of days that a company takes to collect cash after the goods or services have been delivered, is currently (2018) 55 days.

Based on the surveys, PWC concluded that there is a cash release opportunity of RM133bn if companies were to optimize their working capital performance to the top quartile within their industries. Specifically, there are RM 30.7bn opportunity in receivables, RM 35.5bn opportunity in inventory, and a RM 67.1bn opportunity in payables.

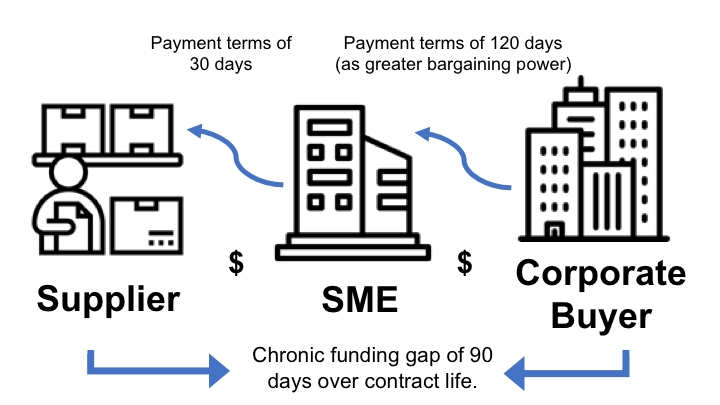

PWC then recommends the use of Supply Chain Financing (SCF) as a way to unlock this opportunity. It identified five principle reasons for implementing SCF:

- Working capital optimization

- Liquidity needs of suppliers

- Supplier relationship improvement

- Improving our EBITDA / cost reduction

- Improve supply chain stability

In the report, PWC also featured us, CapitalBay, a Supply Chain Finance Platform as shown in the extract attached.

Want to unlock cash flow trapped in your supply chain?

Interested in implementing a SCF program?

Contact us now!