12 Ways to Improve your Cashflow Cycle in 2020

The cashflow cycle is a gap between the cash collected from your receivables and payments to be made to your payables. The shorter this cycle, the smoother your business operations because admit it or not, cash flow shows the real picture of a company. Profit only projects your cost and revenue in paper whereas your cashflow statement says how much money your business has at that position of time.

With the new year 2020, set your priorities right!

We have listed some key ways to improve your cashflow cycle. Use these approaches to keep your business rolling, hard and fast!

1. Credit Check – To Vet Your Debtors

A credit check is a MUST to know the past records of your potential clients before engaging with them. Your client’s previous transactions with other parties will give you an idea of whether you can rely on him to make timely payments. So, avoid dealing with people with questionable credit. If you have a doubt but still want to proceed with a client with low credit, make sure to set up the payment with a high-interest rate.

2. Fast Track Your Business Flow – To Move Up Your Payment Cycle

Use efficient tools like Just-in-time (JIT) to manage your inventories so that you can speed up your business flow especially your supply and delivery process. The faster the client receives your good, the faster he will settle your payment.

3. Send Invoices Out Immediately – Early Invoice Means Early Payment

If your payment duration is long, one of the reasons can be your invoices. Send your invoices as soon as you deliver your product or services so that clients can pay you. Make sure you have an easy process to prepare invoices that are easy to fill out and include all necessary details. That way, your invoice can be processed faster, and you will see your money coming back sooner than later.

4. Automated System – Fast Track Your Accounts Receivable System

Use simple software to keep track of your accounts receivable payment timeline since manual tracking of your debtor’s aging schedule can be a little tedious. With an automated system in force, you can send frequent reminders to your debtors when the payment due dates are close and follow up with text and calls if they miss out on the deadline. Moreover, you can align your invoice date with your customer’s payment cycle to smooth the payment flow.

5. Offer Incentives to Debtors – For Faster Collection

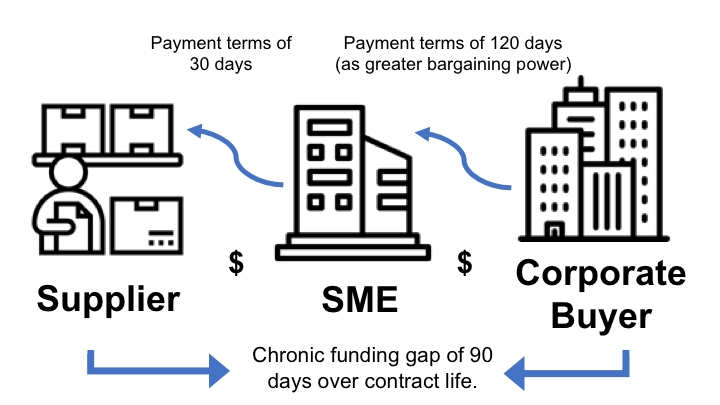

Usually, when you sell your products on credit, you receive the money for your goods after 30-90 days period. This duration can even go as high as 120 days putting a significant gap in your cashflow cycle. Therefore, offer discounts on early settlements to encourage your debtors to pay faster. This will allow you to expedite your cash flow cycle and reduce the chances of delayed receivables collection.

6. Invoice Factoring – Turn Your Invoices Into Quick Cash

Don’t waste your money tied up to debtors. Consider invoice factoring companies to sell your invoices and get instant cash in exchange for a small fee. CapitalBay is one such company that offers as high as 80% upfront cash on your invoices. The remaining 20% value of your invoice is paid once your debtor makes the payment to CapitalBay.

This is an excellent way to instantly collect the money from your debtors to utilize it in other projects. More importantly, it reduces your risk of bad debts and saves valuable time spent on chasing debtors to collect money on time.

7. Regulate Your Accounts Payable – To Get Better Deals From Your Suppliers

Train your accounts payable team to manage your liabilities efficiently. Also, take advantage of the early payment discounts and always make your payments on time. This will increase your goodwill and you can negotiate better rates with your suppliers based on your excellent credit history.

8. Electronic Payments – To Push Back Your Cash Outflow

Electronic payments simply refer to online banking transactions. When you make online payments, your creditors will receive the payments instantly compared to issuing a cheque. So, you can wait until the last minute to pay your creditors. This will allow you more time to keep the cash in your company and hold off the cash outflow as long as possible. As a result, you can buy more time to shorten your cashflow cycle.

9. Find Investing Alternatives – To Finance Your Cash Outflows

It is common to keep a cash reserve for rainy days and sometimes you may have some extra cash sitting around in your bank account. Rather than just leaving the money in the bank account with 0 yields, make some short-term investment to make money. For example, you can put the extra cash in a high-yield savings accounts or invest the cash via P2P platforms to get good returns.

In fact, CapitalBay is opening up its P2P platform in the first quarter of 2020, where you can enjoy more than 10% projected return per year on your investment. This type of investing will not only give you better returns than a savings account, but it will give you an opportunity to diversify your investment portfolio. Moreover, you can use these returns to finance your business operations more efficiently.

10. Revisit Your Inventory – To Prioritize Your Sales

Have a close look at your inventory. You will always find products with low demand that ties up a lot of your cashflow. Besides, it adds up your storage cost causing a cashflow deficit. Instead of waiting for the golden day when the sale of these items will miraculously rise, get rid of these slow-paced products by offering them at discount. This will stack more cash inflow to your cashflow cycle.

11. Leasing Fixed Assets – To Reduce Your Overheads

Prioritize your expenses! Buying fixed assets require spending a large sum of money. You may not always have such a large influx of cash inflow to invest in your fixed assets. The better alternative is to reduce your cost by leasing some of your fixed assets. This will allow you to use fixed assets by paying only a small payment each month, freeing up the rest of the cash to invest in other more important parts of your business.

12. Make Cashflow Cycle An Inclusive Initiative

Don’t burden only your finance team to manage your cashflow. Include the sales and marketing team to give them an idea of the company cash. This will enable all departments to prioritize cash flow by choosing trustworthy customers and manage them accordingly to receive money on time.

The cashflow cycle is a Key Performance Indicator (KPI) that reflects on how long it takes for a Ringgit spent in your business to return into your pocket. You should aim to have your money in the bank before you spend it, in other words, generating a negative cashflow cycle, preferably -6 days. A company becomes much more attractive to investors and other stakeholders when you have a robust cashflow cycle. In many ways, people who put up money in your business will rely more on your cashflow than your profit statement. So, improve your cashflow cycle in 2020 to shape up a smooth-running business by implementing these valuable key points.

Kickstart with the Best Financing Solution!

CapitalBay can help you with the best financing solution if you need assistance to improve your Cashflow Cycle. We offer invoice financing which has the following attributes:

- Easier

- Faster

- Flexible

- Cost-Effective

- Collateral-Free

Check out for more info here and get a free quote for your business financing now.